Table of Contents

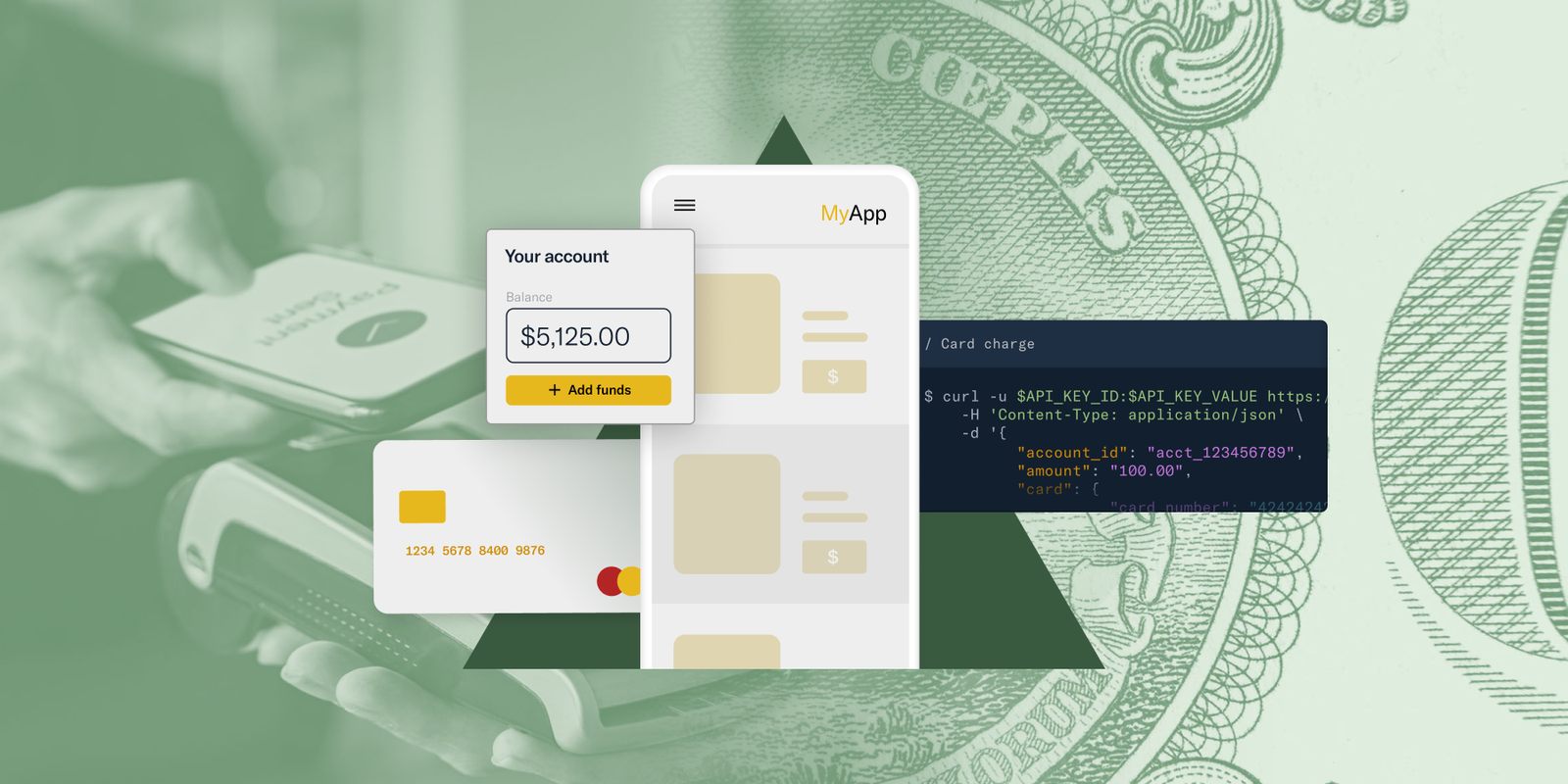

Embedded finance embeds financial products like lending, payments, or insurance into nonfinancial customer experiences and platforms. It’s common to see consumer credit cards at supermarkets and private-label credit lines at retailers or car dealerships.

Streamlining these services in the context of their use boosts adoption and loyalty. The opportunities are immense: revenue growth, accelerated service delivery, data insights, and financial inclusion.

Embedded Payments

Embedded payments allow nonfinancial companies to add financing services directly into their end-to-end customer journeys. This allows e-commerce retailers, software companies, automotive original equipment manufacturers (OEMs), and online marketplaces to create embedded finance propositions that are relevant to their customers’ real-time needs.

Often referred to as buy now pay later or BNPL, these services provide new lines of credit for consumers to make large purchases. They can also give small businesses access to working capital. These financial products reduce the time and expense of traditional processes like applying for a loan or waiting weeks to access trade credit.

The best embedded payments providers can offer solutions that are customized for a specific business model. For example, they may customize the amount offered, repayment terms, and other aspects of a transaction. Moreover, they can help companies avoid costly integration mistakes and deliver a fast and seamless payment experience.

Embedded payments also provide valuable data about consumer or business purchasing behaviors and preferences. This can inform a company’s product development and sales strategies. For example, Toast, an e-commerce restaurant solution provider, uses its embedded payments platform to understand seasonal trends among its customers and surface appropriate lending offers for them. This data can help a restaurant owner optimize operations and save on cash flow. This type of data can also boost a startup’s valuation by enabling it to generate more diversified revenue streams.

Embedded Banking

Embedded financial services allow nonfinancial companies to provide payments, lending and insurance directly on their digital interfaces. This allows businesses such as retailers, software companies and online marketplaces to build their customer experience with a full spectrum of financial products. The ability to offer a range of options streamlines their operations and expands revenue opportunities.

Adding financial services to their online platforms or apps is not new for many companies. Store-branded charge cards for department stores, auto original equipment manufacturers (OEM) offering consumer credit and financing at the point of sale and home improvement retailer Home Depot’s consumer and professional lines of credit are all examples of embedded finance. But the growth of fintech and the rise of application performance interfaces (APIs) have opened up new opportunities for e-commerce, SaaS and other platform providers to expand their product offerings with loans, insurance and payment processing.

These financial tools can be used to enable “buy now pay later,” or to help shoppers decide on the best mortgage rate, credit card or car loan. In some cases, these services are integrated seamlessly into e-commerce checkouts or online marketplaces. In other cases, customers may not know that their purchase is being financed through a banking-as-a-service provider such as Klarna or Clearpay. Choosing the right partner for embedded payments, lending and insurance is critical to success.

Embedded Insurance

Embedded insurance is one of the fastest-growing trends in digital finance. This emerging model allows businesses to offer insurance directly through their products or services, enhancing customer experiences and creating new revenue streams. It also promotes loyalty and trust by reducing barriers and complexity in the traditional insurance-buying process.

Traditionally, buying insurance has required complex processes, including searching for the right policy and then completing paperwork and making payments. This can be frustrating for consumers, especially when they are trying to buy a product or service quickly. Embedded insurance eliminates these obstacles by providing a seamless, simple experience that is integrated into the overall transaction.

This type of insurance is typically bundled with the purchase of another product or service, such as a car-sharing service that includes auto insurance in the price of each ride, or a home warranty plan that can be purchased alongside an appliance. Embedded insurance is becoming increasingly popular among consumers because it provides them with the peace of mind they need in order to make a purchase.

While embedded insurance is a growing trend, there are some risks associated with this type of financing. For example, it can lead to an increase in customer support requests and may distract from a company’s core value proposition. In addition, companies new to this space should ensure that they have the resources and expertise to provide high-quality customer support.

Embedded Risk Management

Embedded finance is the integration of financial tools into nonfinancial company transactions. It enables consumers to access and execute payment processing, credit options, or insurance in the same environment where they shop online, hail a ride, or book their vacation. This approach streamlines the customer journey by removing pain points such as having to seek credit elsewhere or wading through reams of offers when they make a purchase. It can also provide valuable insights on consumer habits and needs that businesses can use to drive future business development.

While the embedded finance trend is gaining momentum, it can be challenging for both financial institutions and nonfinancial companies to get it right. One participant pointed out that advanced technology ensures that a variety of financial services can be seamlessly integrated into the user experience, but it’s crucial to do so in a way that doesn’t alienate customers by overloading them with untargeted offerings.

Another challenge is ensuring that a financial product is seamlessly inserted into the platform where it’s needed by using application programming interfaces (APIs) to connect with the relevant system. The panelists noted that most banks and insurers are not well-equipped to build, document, or promote APIs that can connect with their digital products. This can be an expensive and time-consuming process for both parties. But they stressed that the payoff is worth it.